The Inflation Reduction Act & HVAC/Energy Savings

Amid rising living costs, it’s more expensive than ever to be a homeowner. Many people are cutting back and putting off major home upgrades that could save them money on bills in the long run, but there’s good news for those who are looking to replace old HVAC systems with new, highly efficient models. The Inflation Reduction Act offers homeowners up to $14,000 in rebates as well as tax credits to incentivize energy-efficient home updates. Here’s what you need to know about the act.

Available Rebates

There are two different rebate programs to be aware of. The HOMES Rebate Program will give rebates according to how much energy the upgrades will save after installation. If you make updates that cut your energy usage by 35% or more, you’re eligible for up to $4,000 in rebates. Low-income and middle-income homes can get double that amount for a total of $8,000 in rebates.

The High-Efficiency Electric Home Rebate Act is specifically for low- and middle-income households electrifying their homes. The rebates can go toward things like heat pumps and electric water heaters, for example. Each eligible household can get up to $14,000 in rebates. However, you can’t get two separate rebates for the same upgrade. So, if you were to install a heat pump and claim a HOMES rebate, you wouldn’t be able to get a second rebate through HEEHRA. These are the rebates you can get through HEEHRA:

- $2,500 for electric wiring

- $1,600 for upgraded insulation, ventilation, and air sealing

- $4,000 for an upgraded electric load service center

- $840 for electric stoves, ranges, cooktops, ovens, and electric heat pump dryers

- $8,000 for a heat pump

- $1,750 for a heat pump water heater

In order to qualify for HEEHRA, homeowners need to make 150% of the local median income or less. Funds are set to be available all the way through September 30, 2031.

Available Tax Credit

The Inflation Reduction Act has also expanded the Energy Efficient Home Improvement Credit, which can cover 30% of the cost of installing energy upgrades with a limit of $1,200 each year. The credit was available before the act, but homeowners could only take advantage of it one time. Now, the credit is annual, so you could buy a heat pump one year and a new water heater the next.

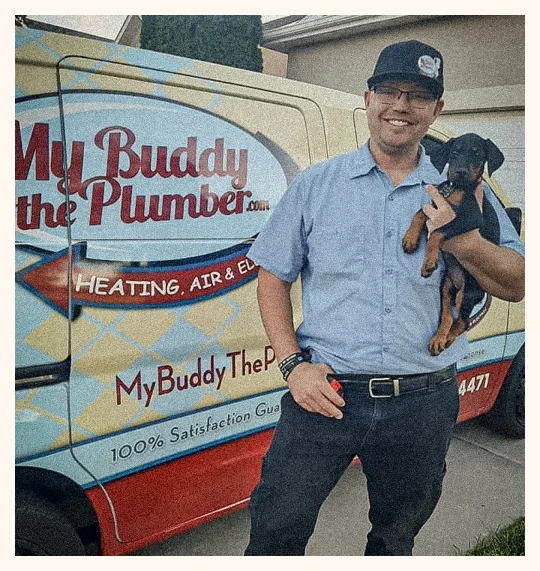

Make Your Home Energy-Efficient With My Buddy

The Inflation Reduction Act will go a long way toward getting Utah homeowners the upgrades they need to save money on bills and cut their emissions. My Buddy the Plumber, Electric, Heating & Air is here to help you select the right HVAC upgrades to snag rebates and the tax credit, and we’ll install them the right way the first time.

Call My Buddy at (801) 381-4471 or contact us online to learn more about our HVAC upgrade options and plan for your updates today.

Recent Posts

Recent Posts

Join the My Buddy Club

Easy Maintenance & Exclusive Benefits

The My Buddy the Plumber’s Club is our comprehensive maintenance membership program that will protect your home comfort systems! From an in-depth home plumbing inspection to thorough furnace and air conditioning tune-ups, the club does it all. Our team will ensure your HVAC, plumbing, and electrical systems are running safely and in top shape. Joining our club can also provide plenty of exclusive perks, such as:

- Priority service

- 10% discount on repairs

- No after-hours fees

- Peace of mind

- Matched manufacturer’s warranty

- Tank water heater flush

- Drain cleaning

- Electrical safety inspection